Allocations

A web app that strives to democratize private equity investing by creating a platform that allows investors to instantly create SPVs and funds decreasing the overall time it takes for investors to invest.

A web app that strives to democratize private equity investing by creating a platform that allows investors to instantly create SPVs and funds decreasing the overall time it takes for investors to invest.

Design a marketplace for investors to buy and sell shares of private companies

Product Designer

UX/UI Design

Wireframing

User Research

Prototyping

Allocations offers fund managers and investors a seamless platform for creating and investing in private equity products. One of the most frequent feature requests we received was the ability to buy and sell shares of the companies users had invested in. At the time, Allocations lacked this functionality, requiring users to manage these transactions manually through external platforms—a process that was inefficient and fragmented. To address this gap, we set out to build the Exchange Marketplace: a centralized solution that enables users to acquire or liquidate shares directly within the platform, while ensuring a smooth and secure transfer of ownership.

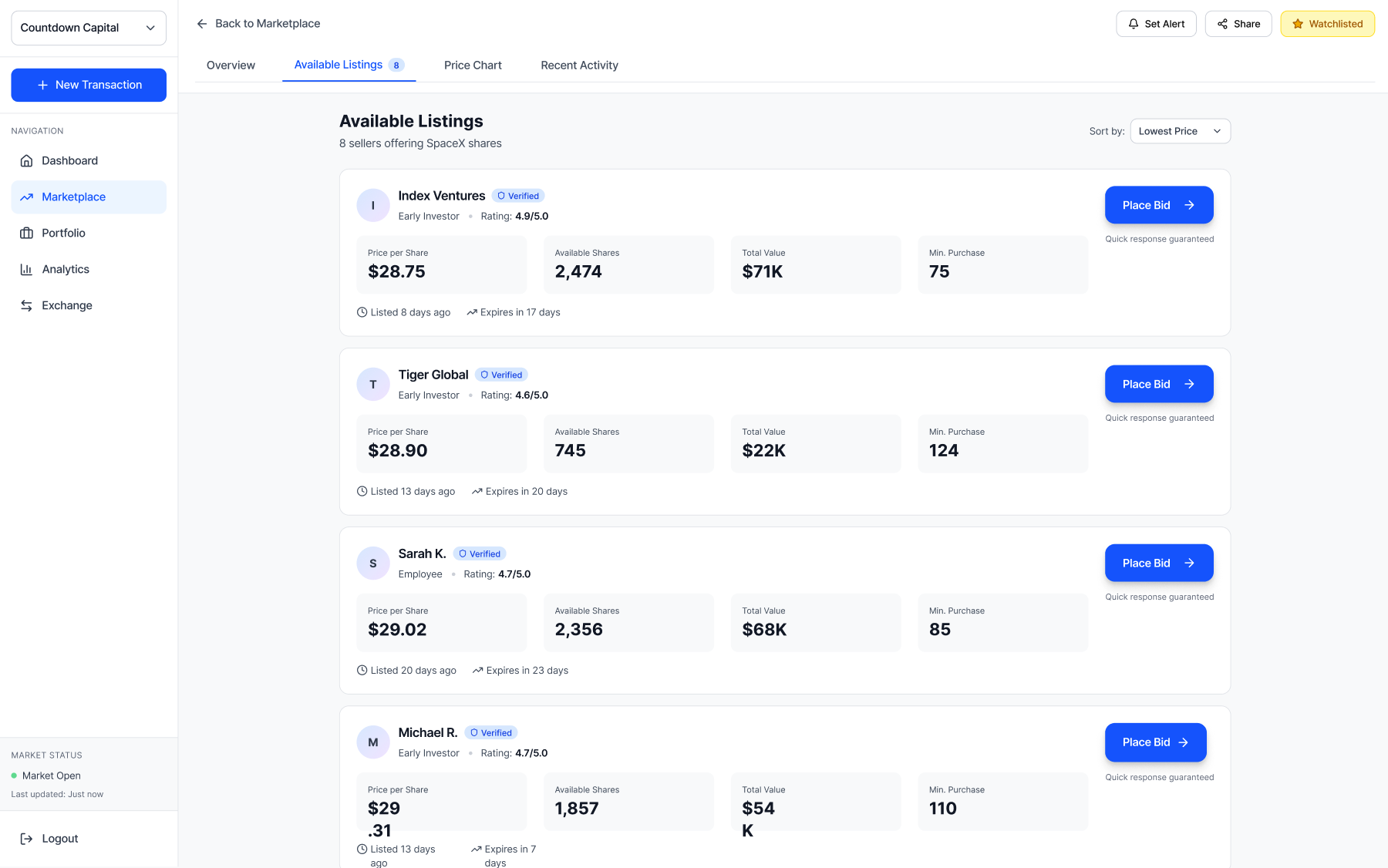

On the home screen of the marketplace, I designed a clear and intuitive card-based layout to showcase each listing, making it easy for users to browse available shares based on the companies they're interested in. Each card prominently features the company logo along with tags indicating the sector, helping users quickly identify relevant opportunities. To further streamline discovery, users can search for listings by company name, industry, or funding round, allowing for a personalized and efficient browsing experience.

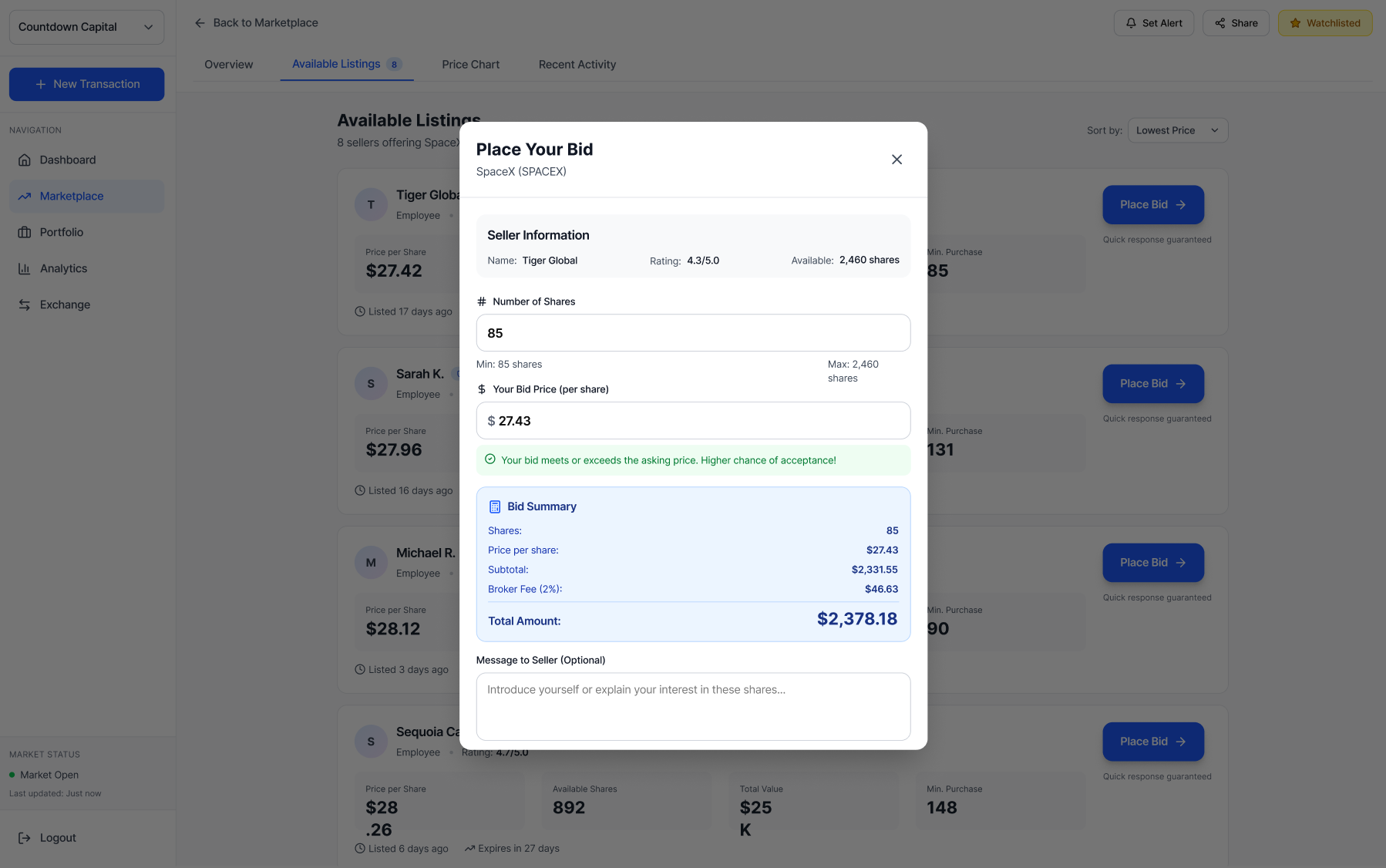

Once a buyer selects a company they're interested in, a modal appears displaying comprehensive information about the investment opportunity. This includes detailed company insights, full investment terms, and input fields where users can place a purchase order by specifying the quantity of shares and their desired price. The goal was to streamline the transaction process while giving users the context and control needed to make confident investment decisions.

Once a bid is submitted, the seller has the option to either accept the offer and initiate the transfer of ownership or respond with a counteroffer at a different price per share. After both parties agree on a final price, they electronically sign the transaction documents, officially completing the transfer of ownership to the buyer. Once finalized, the company card is automatically moved to the appropriate tab for each user, allowing the buyer to seamlessly relist the shares within the platform if they choose to sell in the future. Users can easily manage their activity under the "Orders" section, which includes tabs for "Current Bids" and "Current Listings," while the "Holdings" section organizes their "Purchased" and "Sold" shares for quick reference and ongoing portfolio management.